Medicare Graham Fundamentals Explained

Medicare Graham Fundamentals Explained

Blog Article

Medicare Graham Fundamentals Explained

Table of ContentsThe Buzz on Medicare GrahamMedicare Graham - The FactsMedicare Graham - QuestionsThe Greatest Guide To Medicare GrahamSee This Report about Medicare Graham

A person who takes part in any of these plans can give power of attorney to a relied on individual or caregiver in instance they become not able to manage their events. This implies that the individual with power of lawyer can provide the plan in support of the plan holder and watch their medical information.The Best Guide To Medicare Graham

Make certain that you recognize the extra benefits and any type of advantages (or flexibilities) that you might shed. You might intend to think about: If you can transform your present medical professionals If your drugs are covered under the plan's medicine checklist formulary (if prescription medicine protection is supplied) The monthly costs The price of insurance coverage.

What extra services are used (i.e. preventative treatment, vision, oral, gym membership) Any type of treatments you need that aren't covered by the plan If you intend to sign up in a Medicare Benefit strategy, you have to: Be eligible for Medicare Be enlisted in both Medicare Component A and Medicare Component B (you can examine this by referring to your red, white, and blue Medicare card) Live within the plan's solution location (which is based upon the region you live innot your state of home) Not have end-stage kidney illness (ESRD) There are a few times throughout the year that you may be eligible to transform your Medicare Advantage (MA) plan: The happens annually from October 15-December 7.

Your brand-new insurance coverage will certainly begin the first of the month after you make the switch. If you require to alter your MA strategy beyond the conventional registration durations explained over, you might be eligible for a Special Registration Period (SEP) for these certifying events: Relocating outside your plan's coverage location New Medicare or Component D plans are offered because of a transfer to a brand-new permanent area Lately launched from jail Your plan is not renewing its contract with the Centers for Medicare & Medicaid Provider (CMS) or will certainly stop offering advantages in your area at the end of the year CMS might additionally develop SEPs for sure "outstanding conditions" such as: If you make an MA registration demand right into or out of an employer-sponsored MA plan If you intend to disenroll from an MA strategy in order to enlist in the Program of All-inclusive Care for the Elderly (RATE).

Indicators on Medicare Graham You Should Know

person and have actually become "legally present" as a "competent non-citizen" without a waiting period in the USA To confirm if you're eligible for a SEP, Medicare West Palm Beach.call us. Medicare.

Second, check out regular monthly costs and out-of-pocket expenditures. Determine exactly how much you can spend based on your budget. Third, think about Discover More Here any kind of clinical solutions you may need, such as validating your present doctors and experts approve Medicare or locating insurance coverage while away from home. Read regarding the insurance coverage business you're considering.

The Facts About Medicare Graham Revealed

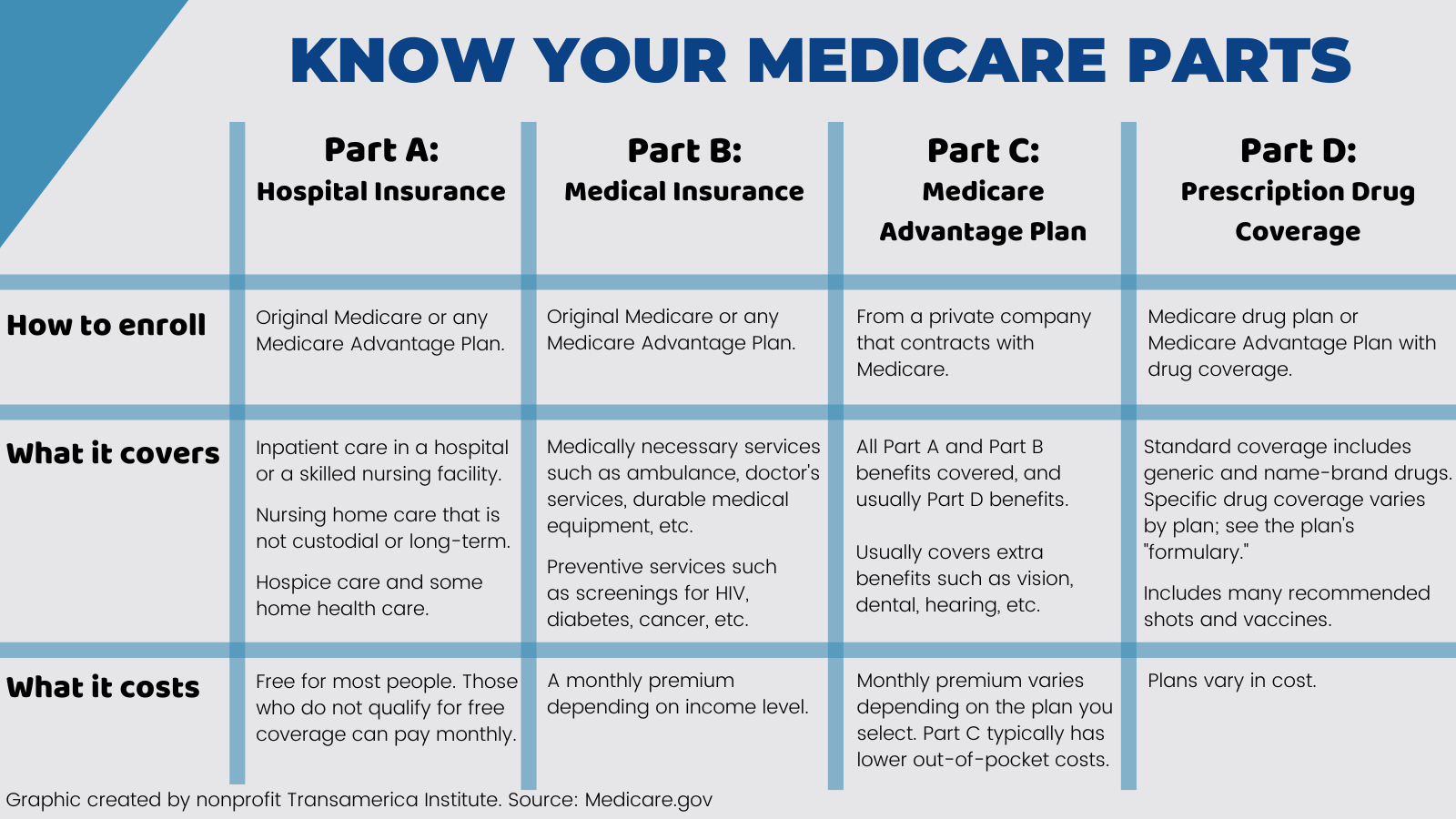

To pick the ideal insurance coverage for you, it is necessary to understand the fundamentals regarding Medicare - Medicare West Palm Beach. We've accumulated everything you need to learn about Medicare, so you can choose the strategy that finest fits your demands. Let's stroll you via the process of how to examine if a Medicare supplement plan may be appropriate for you.

Medicare supplement strategies are simplified into courses AN. This category makes it easier to contrast several supplemental Medicare strategy kinds and select one that ideal fits your requirements. While the standard benefits of each type of Medicare supplement insurance strategy are consistent by copyright, costs can range insurance policy companies.: In addition to your Medicare supplement strategy, you can select to acquire added coverage, such as a prescription medicine strategy (Component D) and oral and vision insurance coverage, to assist meet your details requirements.

You can discover an equilibrium between the plan's expense and its insurance coverage. High-deductible plans provide low premiums, yet you may need to pay more expense. Medicare supplement plans normally have a constant, predictable costs. You pay a monthly premium for low or no added out-of-pocket expenses.

The Best Strategy To Use For Medicare Graham

Some strategies cover foreign travel emergency situations, while others exclude them. List the clinical services you most worth or may require and make certain the plan you select addresses those requirements. Private insurer offer Medicare supplement plans, and it's a good idea to review the fine print and compare the worth various insurance companies supply.

It's always a good idea to talk to representatives of the insurance carriers you're thinking about. Whether you're switching Medicare supplement plans or shopping for the very first time, there are a few things to consider *.

Report this page